Navigating the aftermath of a personal injury case in Florida can bring a wave of relief when a settlement is reached, but it often raises the critical question: Are these settlements taxable? The answer is not a simple “yes” or “no”—it’s a complex interplay of state laws and tax regulations that can perplex even the most astute individuals. As the top accident lawyers based in Tampa, Florida, we understand the nuances of your settlement’s tax implications. We’re not just your personal injury lawyers.

We’re also advisors deeply embedded in the local fabric, well-versed in both the emotional and fiscal aftermath of your lawsuit. In this article, we demystify the tax status of personal injury lawsuit settlements in Florida, ensuring you’re equipped with the knowledge to make informed decisions post-settlement.

The Core of Personal Injury Settlements: What Qualifies as Taxable?

Personal injury settlements in Florida aren’t just about the numbers—they’re about your story and your recovery. These settlements look to compensate for injuries sustained, aiming to restore what was lost. Florida’s tax code generally echoes this sentiment: Compensation for physical injury is not taxed, keeping your restitution intact.

At Hunter Law, we know that behind every settlement is a person seeking fairness. Our personal injury lawyers are here to ensure you understand the tax rules that apply, offering peace of mind as you heal.

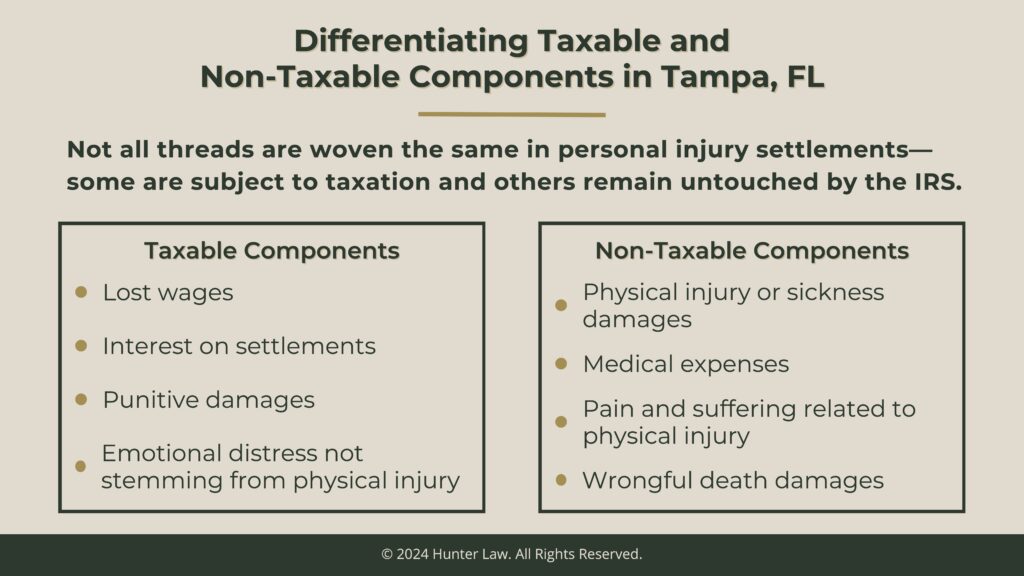

Differentiating Taxable and Non-Taxable Components in Tampa, FL

When it comes to personal injury settlements, not all threads are woven the same—some are subject to taxation, while others remain untouched by the IRS. Knowing which are taxable or not can significantly influence your financial strategy post-settlement. Let’s unravel the taxable from the non-taxable:

Taxable Components:

- Lost Wages: Reflects income you would have earned, taxed as if you had received it as salary.

- Interest on Settlements: Any interest accrued on the settlement amount is considered taxable income.

- Punitive Damages: Aimed to punish the defendant, these exceed compensatory damages and are taxable.

- Emotional Distress Not Stemming from Physical Injury: If it’s not related to a physical injury, it’s taxable.

Non-Taxable Components:

- Physical Injury or Sickness Damages: Compensation for the injury itself is not taxed.

- Medical Expenses: Costs associated with treating the physical injury are non-taxable.

- Pain and Suffering Related to Physical Injury: Non-taxable as it is a direct result of the injury.

- Wrongful Death Damages: Non-taxable when awarded as part of a wrongful death compensation under specific conditions.

With Hunter Law’s personal injury lawyers by your side, navigating between taxable and non-taxable elements becomes clearer. Our Tampa car accident lawyer team, well-versed in drunk driving accident cases to bus accident claims, ensures that your financial recovery is as robust as your physical and emotional healing. Our commitment is to provide you with a precise understanding of these components, offering a beacon of guidance in the complex aftermath of personal injury settlements.

Typically, the damages received from a personal injury settlement are not itemized. What that means is that because the lost wages aren’t delineated, the entire settlement is typically not subject to any taxes. Things are different when a plaintiff goes all the way to a jury verdict. In those cases, the damages are itemized, and tax implications may arise.

The Role of Legal Guidance in Your Settlement Process

At the heart of every personal injury claim in Florida lies a complex set of decisions—ones best navigated with seasoned personal injury lawyers. Consulting with a legal professional is not just about building a case—it’s about understanding the full scope of your rights and the nuances of your potential settlement. Whether you’re dealing with a slip and fall incident or an auto injury in Tampa, Hunter Law can provide the guidance needed to steer through the legal intricacies and ensure that your settlement reflects the true extent of your claim.

Tax Deductions and Personal Injury: Are Attorney Fees Tax Deductible?

Misconceptions about tax deductions can lead to costly mistakes, particularly when it comes to legal fees in personal injury cases. Many believe that all legal expenses are deductible. However, the reality is more selective. At Hunter Law, our professionals bring clarity to these murky waters, offering insights into which legal fees may be deductible and how they can impact your overall tax obligations. Trust our Tampa-based team to debunk the myths and deliver the straight facts on tax deductions related to your personal injury lawsuit.

Secure Your Financial Future with Best Legal Advice

If the resolution of a personal injury claim brings new financial questions, you’re not alone. Reach out to Hunter Law for clear, personalized guidance on how your settlement may impact your taxes. With specialized knowledge in Florida’s legal nuances, from bus accident lawyers to slip and fall lawyer needs, our team is committed to providing the support you need. Take the proactive step toward safeguarding your settlement—contact us today for a consultation with the best lawyers in Florida, and let us help you navigate with confidence. Call Hunter Law at 813-287-2227.